Building a diversified income portfolio

How to navigate an ultra-low yield environment while trying to build a diversified income portfolio

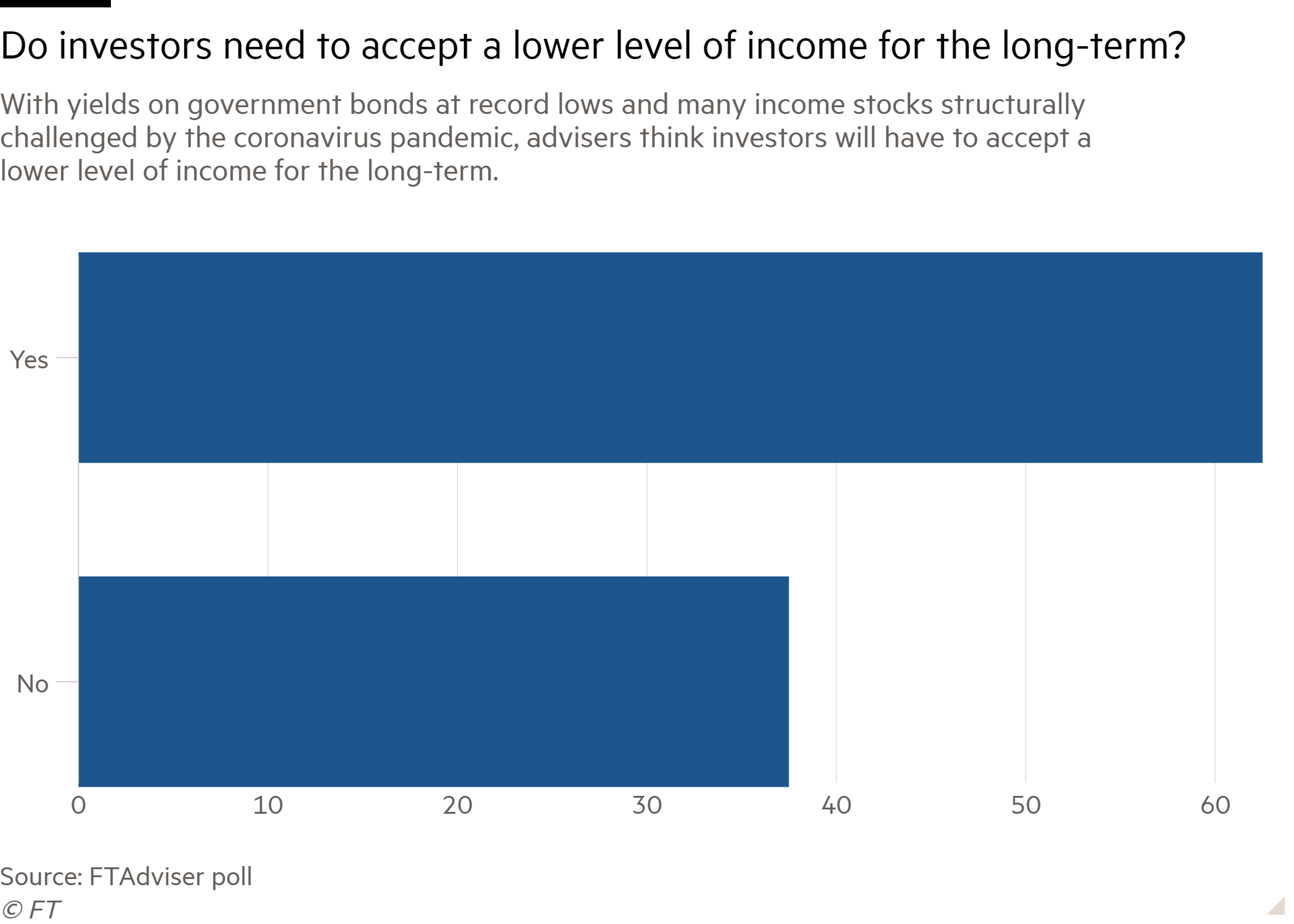

There was once a time in the not too distant past when an adviser could rely on UK or US government bonds to provide a slug of income yield, while also acting as a diversifier for the equity part of the portfolio.

But in the decade since the global financial crisis, the yields on most developed market government bonds have shrunk to below one per cent, taking away some of the income potential.

So investment managers are now looking at different ways that they can build a diversified income portfolio: taking a journey on a road less travelled.

In this report, we will look at what the future could hold for the fixed income market and how advisers can build a diversified income portfolio.

The nature and condition of markets means that clients will need to accept a lower income yield from their portfolios in future, according to a majority of the advisers who responded to our latest FTAdviser poll.

Our data shows that 62 per cent of advisers believe clients will have to accept a lower income in future, while 38 per cent believe previous income levels can be maintained.

The poll was conducted via the FTAdviser twitter account.

Advisers putting together income portfolios for clients have faced the challenge in recent years of the yields on government bonds being at record lows, while many of the stocks that have been staples of equity income portfolios for decades, such as the big oil companies, may be structurally challenged in the world after the pandemic.

Meanwhile, many of the stocks likely to benefit from the deep societal and economic changes that may be the outcome of the pandemic are companies which pay little in the way of dividends.

The third challenge facing advisers is that clients are likely to live much longer in drawdown than was the case in the past, meaning the pot of money has to last longer, reducing the capacity for the client to deplete capital.

Building an income portfolio in a low-yield environment

Words: David Thorpe

Images: Fotoware and Pexels

Building an income portfolio, with a yield that served the client adequately, used to be relatively straightforward.

An adviser could rely on UK or US government bonds to provide a slug of income yield, while also acting as a diversifier for the equity part of the portfolio.

But in the decade since the global financial crisis, the yields on most developed market government bonds have shrunk to below one per cent, taking away some of the income potential.

Dominic Fisher, who runs the Thistledown Income fund, a multi-asset product says: “There is now no need for a client to have a ten year government bond, if you are going to own that, you might as well just have cash in the bank.”

Many investors have long been sceptical about the potential for government bonds to perform the second part of their role, as a diversifier.

This scepticism arises as yields had already fallen to record lows, meaning the assets were already trading at record high valuations, and so may not have the capacity to rise further as equities fall.

But in the great Covid sell-off in March, government bonds did rise in value even as equities tumbled, reinforcing their role as diversifiers.

David Jane, who runs a range of four multi-asset funds at Premier Miton, says he continues to own some government bonds, with a short date to maturity, in his portfolios, for these diversification benefits.

There is now no need for a client to have a ten year government bond, if you are going to own that, you might as well just have cash in the bank.

The diversification advantages are not enough to tempt Steven Hay, multi-asset fund manager at Baillie Gifford, to own government bonds in his fund. He says: “The thing about government bonds now is that at these yields, you know you are going to lose money.”

Mr Hay is particularly concerned that inflation could rise in the years to come, and were that to happen, it would reduce the already meagre purchasing power of the income earned from government bonds.

Fixed Income flux

Vincent McEntegart, who runs the £817m Aegon Asset Management Diversified Monthly Income fund, says: “The days when you could see your equity portfolio fall in value but the government bonds segment rise to make up for the fall in equities is now sadly a distant memory.

“The bonds may still rise in value, but the yields don’t come anywhere near to making up for any equity market loss.”

Dickie Hodges, bond fund manager at Nomura Asset Management cautions against investors expecting bond yields to rise in the near future.

He says: “The rebound we have seen in some markets is not a true reflection of the economy, so won’t lead to interest rates rising. What will happen next is there will be a lot of inconsistent economic data and that won’t lead to higher rates.”

But if fixed interest has been in the doghouse with investors, those who turned to equities to make up any income shortfall have been presented with two problems.

The first is that, since the global financial crisis, the parts of the equity market that have performed best have also been the parts with the lowest income yield.

This is particularly the case with the large technology companies in the US, but also the consumer staple stocks in the UK.

Those equities which have paid dividends have, in contrast, been those equities in areas where business models are challenged by technological or societal changes, or that have been paying the dividends from debt or retained earnings, rather than from the cash generated by the operations of the business in a given year.

The bonds may still rise in value, but the yields don’t come anywhere near to making up for any equity market loss.

Mr Hay says that with any bonds rising in value - when a bond yield falls that means the price is rising - many investors have started to view bonds as an asset to own for capital gains, and equities as an asset to own for income, inverting the traditional asset allocation mix.

But Mr Hay is adamant that bonds should still be viewed as an income investment. While he has moved away from government bonds in developed markets, he is increasingly focused on emerging market debt.

He says: “We tend to divide the portfolio into three buckets as a starting point; bonds, equities and alternatives. Looking at the bonds, there are still good yields to be had in emerging markets and in high yield.”

Emerging market economies tend to perform best when global GDP is expanding and when the dollar is weak.

The global economy should be expanding in 2021 as the world emerges from the pandemic, while the dollar has been weaker in recent weeks for the same reason.

When investors fear for the prospects of the global economy, they tend to buy the dollar (either directly or via the US government bond) as a safe haven, but as economies open up, investors become less focused on owning safe haven assets and more willing to embrace risk.

This causes a sell-off of dollar based assets, and relative weakness in the currency. In addition, any stimulus plan agreed by the US government would also be expected to weaken the currency.

Mr Jane is keen on high yield bonds. He says: “If you were trying to create the ideal market conditions for high yield bonds, they would look like this, with very low yields on government bonds, central banks doing QE and economies returning to growth.

"The bit of high yield we like is right at the top of it, the best quality bit of it, we wouldn’t be keen to go further down.”

Darius McDermott, who runs the multi-manager fund range at Chelsea Financial Services, says he has sharply reduced the long-term bond allocations in his income funds, and instead has added alternative income products, such as renewable energy investment trusts and infrastructure investment trusts.

Alternative approach

Mr McDermott says the income from many of these assets is government backed, so almost as secure as a bond, but with a higher yield.

John Moore, senior investment manager at Brewin Dolphin says such alternative income products can, by boosting the overall yield on portfolio, enable an investor to focus on equities that have a lower yield but more growth, creating a better total return for clients,

Chris Hiorns, multi-asset income investor at EdenTree, is also keen on the investment case for infrastructure assets, which he noted held their value in the pandemic induced sell-off in March.

Richard Parfect, multi-asset investor at Seneca Investment Management, says that many of the most attractive alternative income assets have already risen in value, to the point where he has begun to sell some holdings.

Mr Jane says: “We do own some of these but I think it’s important to understand what you are buying. These are not really alternative assets, they are either a form of equity or a form of debt, and should be viewed as correlated to those assets.”

Looking at the bonds, there are still good yields to be had in emerging markets and in high yield.

For example, if bond yields were to rise sharply, the yield on assets such as infrastructure would then look relatively less attractive, and the likelihood is that the prices of those alternative income funds would fall.

Equity endeavours

Building an equity income portfolio is “easy” in normal times, according to Mr Jane.

He uses what is known as a “barbell” approach, whereby he buys a large number of equities he believes will go up, though which may have no yield, and subsequently invests those gains in income bearing assets that may not have much growth.

He says this approach was challenged for most of 2019 because there was a period when most assets were unable to pay a yield, although as economies open up, he expects the yield payers to return.

Robert Hird, head of investment strategy at Premier Wealth Planning, says if a client is expecting a 5 per cent yield from their portfolio, then “expectations have to be managed” as to the level of risk required, and the need to potentially own more equities.

These are not really alternative assets, they are either a form of equity or a form of debt, and should be viewed as correlated to those assets.”

He tends to boost the income available by investing in equity funds that sell options, such as the Schroders Dividend Maximiser.

This fund, and others like it, trade the future capital gains from a stock in exchange for a payment today, which is used to fund a higher dividend.

The premise is that investors in such funds prioritise income ahead of capital return and so the fund should do the same.

Chris Murphy, who runs the £1bn UK Equity Income fund at Aviva Investors, says that companies such as Shell and BP, were paying unsustainable dividends prior to the pandemic, and this supported the share price, as almost all income fund managers owned some of the equity as a way to boost the yield they could offer.

But he says the future outlook for those stocks and their yields is permanently impaired, and cautioned against owning such assets simply because they appear cheap right now.

Mr Moore says: “Within equity income, we are placing more focus on total return rather than initial income, with say a 2 per cent - if not lower - starting yield rather than say 4 per cent, which was a recognisable industry rule of thumb, pre-pandemic.

"We are also placing more emphasis on overseas equity exposure, with the US, offering exposure to income from leaders in technology and sectors that are not particularly represented in the UK. Likewise, Asia offers end market growth potential and initial income from stocks and sectors reflected closer to home.”

Mr McDermott says he is increasingly looking to investment trusts for income. Investment trusts can pay income from reserves, something which he describes as “a very attractive feature”, as it means the income can be more durable over the long-term, including in a year when the market is generally challenged, as it has been this year.

The US Stock Exchange. C:Michael Nagle/Bloomberg

The US Stock Exchange. C:Michael Nagle/Bloomberg

Horlicks: A household favourite by Unilever. C:Bryn Colton/Bloomberg

Horlicks: A household favourite by Unilever. C:Bryn Colton/Bloomberg

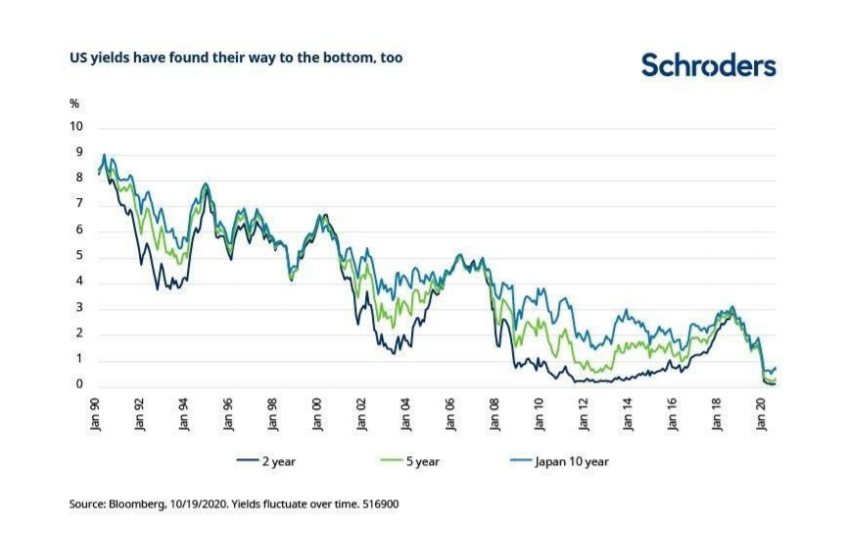

Darius McDermott, from Chelsea Financial Services, has added alternative income products in his income funds, such as renewable energy investment trusts. C:Mike/Pexels

Darius McDermott, from Chelsea Financial Services, has added alternative income products in his income funds, such as renewable energy investment trusts. C:Mike/Pexels

David Jane, from Premier Miton uses the 'barbell' approach. C:Leon Ardho/Pexels

David Jane, from Premier Miton uses the 'barbell' approach. C:Leon Ardho/Pexels

In looking across the investment landscape, there is a need to solve the problem of #TheZero.

In some ways, and for many, #TheZero is inescapable. We’ve started seeing zero everywhere. It’s in interest rate policy; it’s in returns on bonds. Zero is the gateway to negative.

We are at the beginning of a prolonged period of policy-led financial repression, where we will all have to focus on #TheZero, its impact on investment decision-making and its impact on asset allocation.

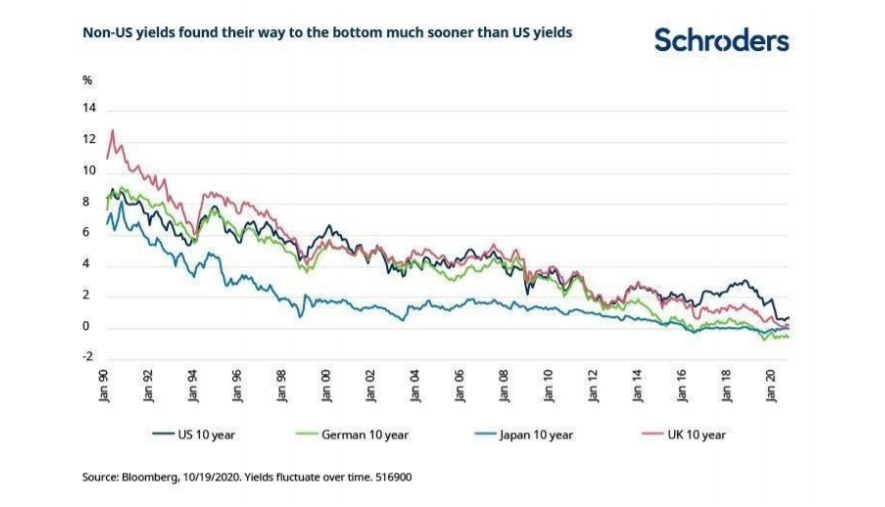

Of course, #TheZero is not new; we have seen near-zero interest rates in Japan as well as in Europe. However, when those local rates declined, the US became a haven of sorts - it was the higher yielding developed economy. This is no longer the case; zero interest rate policy is here to stay, at least for the foreseeable future.

But #TheZero also has implications for how we live our lives, not just our investments.

Change of plan?

I’ve always liked simple concepts. The simple life plan was always: work hard, get a scholarship, educate yourself, get a job, care for your loved ones, save money, invest, retire and live off of the income your invested savings generate.

Invested retirement savings, as a simple rule, meant bonds. Using bonds was the plan because you could earn income and maintain your lump sum (the principal). Simple plan. Iron-clad even, or so I thought.

But what happens when the coupon income generated by bonds is close to zero?

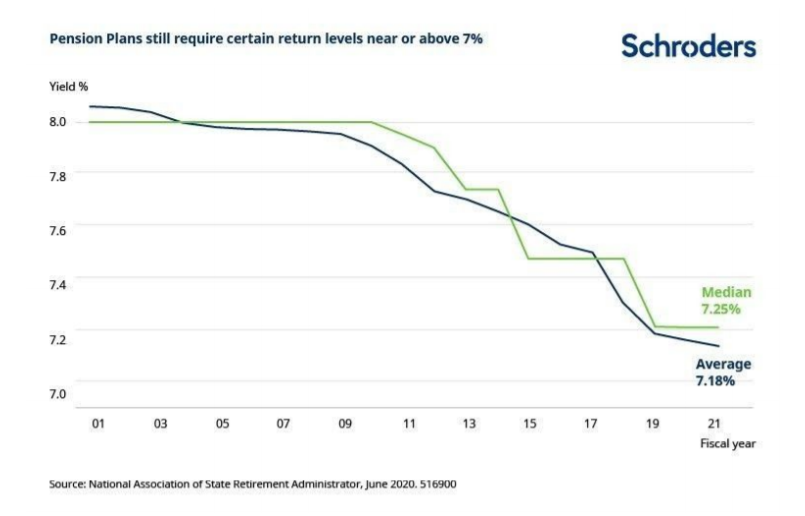

With zero income, the maths no longer works for retirees, not to mention for those that manage pension plans for the benefit of retirees. What’s more, in an ageing society, this problem is compounded.

If savings do not generate adequate income, you have three options: you must be willing to spend down your savings, you must be willing to reduce your expenses, or you must continue working for a longer period prior to retiring.

This is the impact of “#TheZero”, and it will get a lot of attention, it certainly has mine.

Macabre? Yes. But is it escapable? Definitely.

Past performance disclaimer

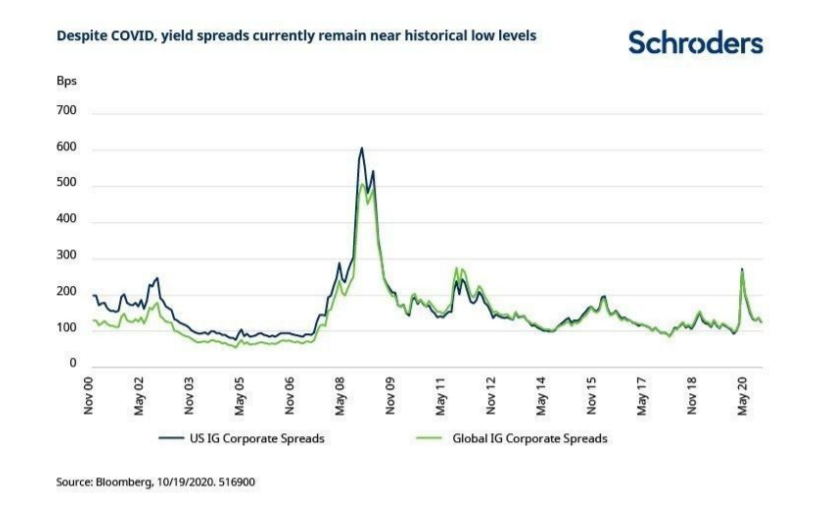

For bond investors there have been four significant sources of return over the past four decades: duration, roll-down, coupon and spread.

They are all going to be far less significant in the years to come. #TheZero has seen to that.

It’s reminiscent of the widely-used disclaimer: “past results are not indicative of future performance.”

Look to the road less travelled

So, with traditional sources of yield and returns declining, where can attractive returns be found?

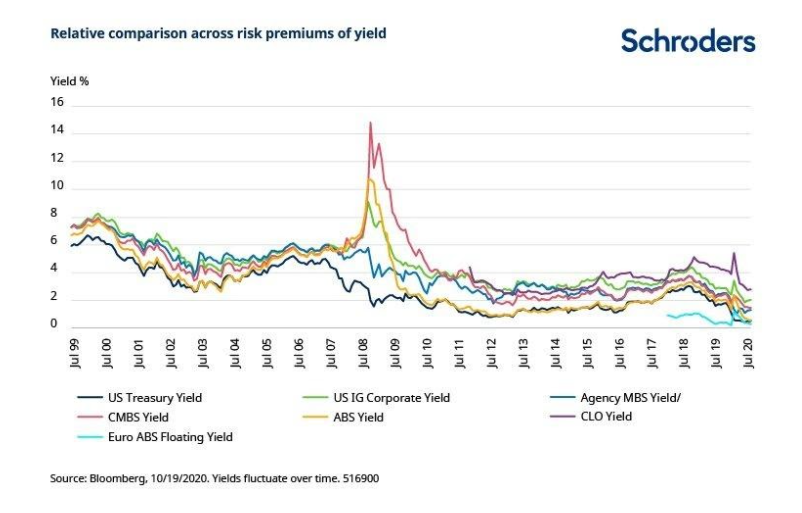

Presently, we see more attractive yields coming from more esoteric areas such as Asset Backed Securities (ABS), Collateralized Loan Obligations (CLOs) and Commercial Mortgage Backed Securities, than from the more common traditional benchmarked credits.

For example, today the European ABS index offers more attractive metrics relative to US IG credit than at any point in the last three years, implying that the premium for the complexity is more attractively priced today.

This is the benefit, in the words of the poet Robert Frost, “the road less travelled”.

When looking at yield alone, you can see that it’s in traditional assets that risk premiums have been reduced the most in the now decade long voracious search for yield.

Set your priorities

In evaluating solutions for #TheZero, there are certain critical factors that need to be emphasised. These are stronger fundamentals, better tolerance to volatility, and lower sensitivity to interest rates. At the same time, there are various factors that should be de-emphasised.

Within a portfolio, each asset should serve a purpose, based on the factors that it emphasises. The building blocks of a successful strategy will likely require new thinking about sources for return, such as:

Fast liquidity: For most, some component of a portfolio needs to be used for liquidity. Liquidity is one area that requires a re-examination in light of the changing size of various markets, and the securities within them.

Opportunity: Based on their exposure to certain themes or trends, some products benefit from opportunity, either right now, or down the road. Opportunities today are more likely to include those that are housing related, but future opportunities will include real estate-, consumer- and corporate-related.

When looking at yield alone, you can see that it’s in traditional assets that risk premiums have been reduced the most in the now decade long voracious search for yield.

Recovery: Other types of opportunity can be driven by mispricing. Recovery opportunities are often the “babies thrown out with the bathwater” in dislocated or uncertain markets.

Carry: Assessing the carry of a bond in consideration of its duration and potential volatility should be a key driver. If this is desirable, our view is that a sector like ABS affords these characteristics more so than many other sectors.

Evolution: Lastly, liquidity takes us into another dimension of risk premium. The terms of liquidity can range in terms of return and in terms of lock-up. This is another tool that could be used to improve or reduce risk within a portfolio in #TheZero.

Break with tradition

In looking across the investment landscape, there is a need to solve the problem of #TheZero. Participants in all markets alike will need to consider diversifying sources of return beyond traditional markets, or traditional thinking.

It has been said that “underneath every revolution lay a zero”, and from an asset allocation perspective, this time is no different. We believe that we are just now at the beginning of changes to fixed income asset allocations in order to more aptly navigate #TheZero.

Within a portfolio, each asset should serve a purpose, based on the factors that it emphasises. The building blocks of a successful strategy will likely require new thinking about sources for return

With very low structural yields and returns we must consider more risks, rather than just more risk as the backbone of portfolio construction. Consider a more diverse basket of less correlated assets to embed resilience. We believe this is the order of the day.

A re-assessment is essential given the new challenges of the zero paradigm. The sustainability of this recovery may be challenged and even a mere delay in the expected US fiscal package has altered expectations.

Unemployment perceived as temporary will begin to shift to unemployment perceived as permanent. Policies that helped companies and consumers bide time through non-payment will expire, and we may see another wave of layoffs and increases in bankruptcy filings.

We believe these challenges will begin to mark the second phase of this economic crisis and recovery, as we begin to see new data, we may initially see the death of optimism.

There will likely be renewed opportunities to benefit from structural changes taking place in the economy, be they social, political or economic.

Generating successful investment outcomes with an uncertain economic backdrop is hard. With high asset prices, and with very little income offered in traditional markets, it is very hard.

But as Tom Hanks said in 'A League of Their Own', a movie about women taking over the US Professional Baseball League during WWII: “It’s supposed to be hard. If it wasn’t hard, everyone would do it. The hard… is what makes it great.” – and there is NO crying in baseball.

Michelle Russell-Dowe is head of securitized, US fixed income and Nicholas Pont is investment director at Schroders.